Closing a Placement

In the early days of your business, closing a financing round like a private placement comes down to your ability to imagine, convey, and deliver on a promising venture vision. Once you master these core business skills, it just comes down to the right audience. 💼 An executive of our client said one surefire approach to convince investors:

"Do something that you love, because you'll put in the work behind it."

— Angel Laylor

We are currently streamlining the offering process through smart contracts that put these agreements on Soroban, so that you can raise from any verified users of Stellar. This is just one example of continuing to work steadfastly while racking up momentum, clientele, and experience. When you can just stick with your work, stuff will happen:

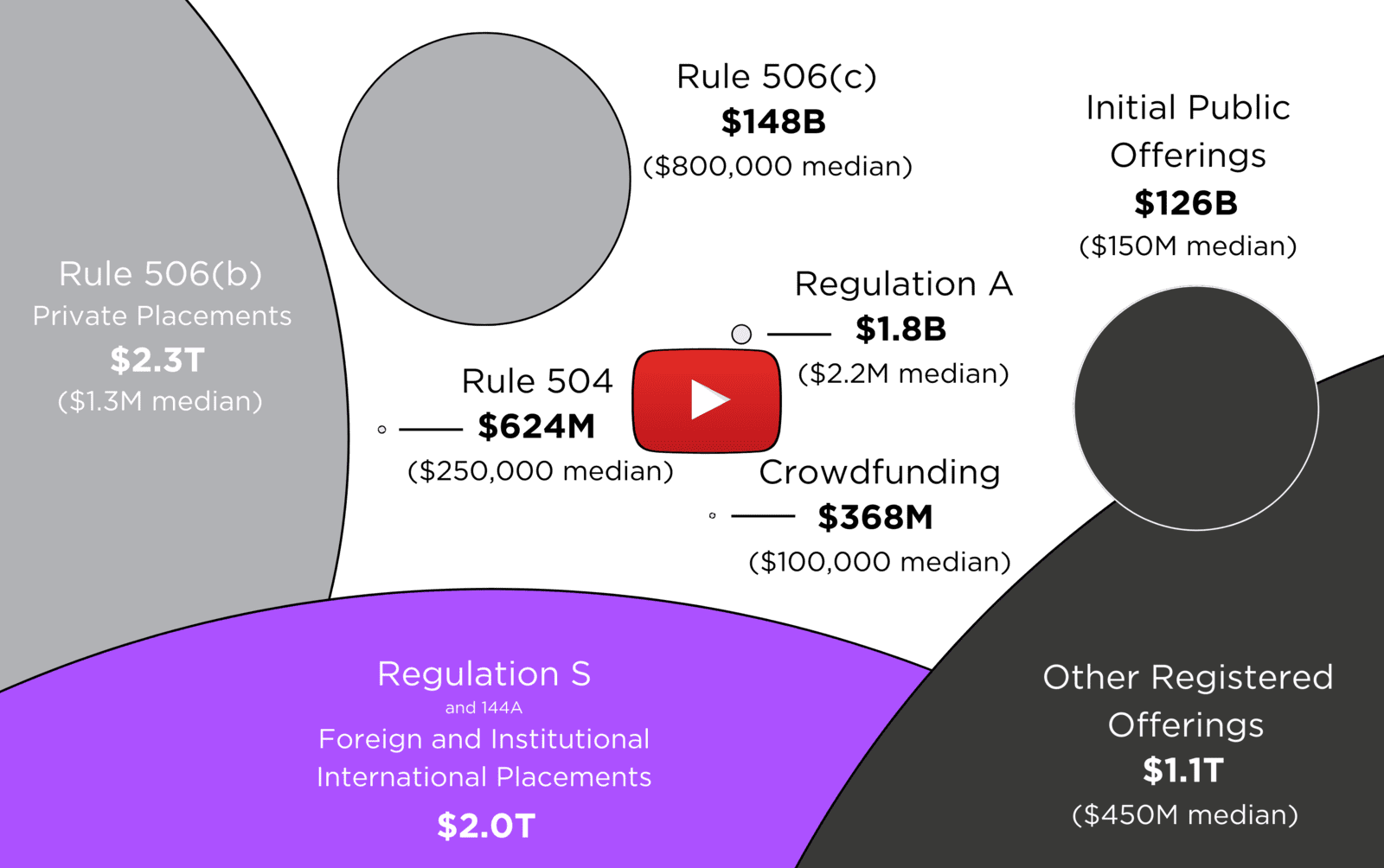

Relevant insights, albeit inspired by TVDH.

Pitching your startup can be one of the best ways to quickly understand your value proposition to investors and the market you'll serve. 🗣️ As Min-Liang Tan popularized, this can well start off with building something both "for and by" your community. Once you're off to the races building, it's a very short leap to selling inaugural users.