If you've ever owned shares in a corporation, you've likely been invited to have your say in important company decisions, from electing board members to approving mergers. While this sounds straightforward, the reality is far from it. 🌀

The traditional proxy voting system is a maze of paper ballots, phone calls, and centralized control numbers that can leave even the most diligent shareholder scratching their head. 🤔

Why does this matter? Because shareholder voting isn't just a formality; it's a pivotal aspect of corporate governance that directly impacts your investment. The voting process gives you the power to influence management decisions, potentially boosting stock performance by tapping into the collective wisdom of a diverse investor base. But what if this system, designed to give you a voice, is so flawed and cumbersome that it effectively silences you? 🤐

Deep challenges and inefficiencies plague the traditional proxy voting system. But what if there was a way to not only simplify this convoluted process but also make it more democratic? 📈

The Quagmire of Proxy Plumbing 🗳️😵

Bank of America counted 130% of its shares voted...

they received 30% more votes than they had shares outstanding.

That‘s just the number of people who actually voted their shares!

Imagine how many shares were sold beyond what they actually authorized and issued.

This violates the voting rights of shareholders and reduces effective corporate governance.

— Lucy Komisar

The Phone Fiasco 📞

The Paper Chase 📄

Control Number Quandaries 🔧

- Data Breaches: Centralized systems are a goldmine for hackers. A breach in the system could compromise the control numbers, leading to unauthorized voting or even vote manipulation. 💻

- Tally Errors: The centralized nature of control numbers makes it easier for insiders or third parties to manipulate votes. Errors in the system can also lead to incorrect vote counts, as was the case in these examples:

- Yahoo's 2008 Director Election: Yahoo was forced to recount votes in its contested 2008 director election due to significant errors in reporting votes. The centralized control system failed to ensure an accurate count, leading to a recount that not only delayed the process but also raised questions about the integrity of the US equity shareholder voting system. 📊

- Proxy Middlemen and Dell Buyout: In the buyout of Dell Inc., T. Rowe Price intended to vote "no" but, due to a complex chain of intermediaries and default settings, their vote was cast as "yes." This resulted in $TROW losing $194 million. 💰➡️🗑️

- 2017 Procter & Gamble Proxy Fight: Many proxies were invalidated due to systemic issues such as breaks in the chain of custody and improperly filled proxy cards. The centralized control system was unable to prevent these issues, leading to a recount and undermining the legitimacy of the entire process. 🥊

Three Top Threats to Democratic Elections ⚖️

Empty Votes ❓

They can, in fact, throw out your vote and just not count it.

They can randomly assign your vote to some real proxy that wasn‘t voted.

They can vote what shares they actually do have proportionally

based on how many phantom votes come in. It‘s all done in secrecy.

They don‘t have to tell you, they don‘t have to tell the NYSE, they don‘t have to tell anyone.

They don‘t have to tell the company whose shares they voted.

— Dr. Susanne Trimbath

Overvoting 🤯

Veil of Anonymity 🚫

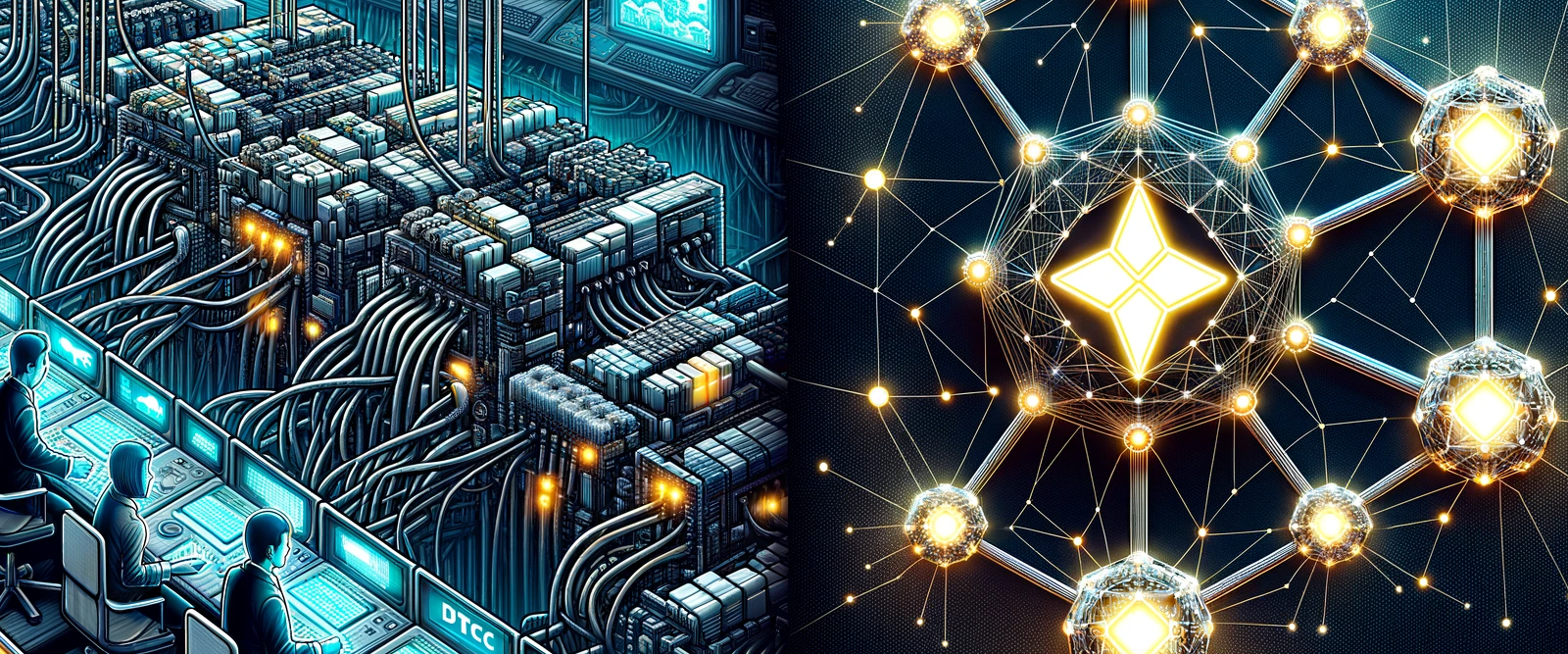

Our Solution 🛠️🌍

Our systems make every vote traceable and transparent. Once voting opens, we send investors standard proxy notices. But instead of dialing a call center or mailing back a postcard, investors use a wallet app to cryptographically vote with math. They go through an interface with the voting items specific to each meeting, selecting "for," "nay," "abstain," or "withhold" for each item. These choices get encoded in a transaction memo, which is then sent to a public blockchain voting address. At the meeting, vote results from these public distributed ledger are reconciled with shareholder record-date balances as recorded on the blockchain. Anyone can tally up public transaction memos to verify final counts, and all votes have the same security backing our stock transfers. 🔍

So, if you're tired of navigating the labyrinthine world of proxy voting, where middlemen dictate the rules and companies are left in the dark, it's time for a change. At Block Transfer, we're revolutionizing the way proxy voting is done. No more hidden fees, no more anonymity barriers, and no more convoluted processes. Just a straightforward, user-friendly system that makes your voice heard. If you're ready to make the switch and experience the future of proxy voting, we invite you to schedule a free brief consultation with us. Let's change the game together. ⛓️